JB KYC And Verification

This page explains what KYC means at JB, when it’s required, which documents you may need, and how to complete verification. You’ll also find location rules, monitoring notes, and quick fixes.

What KYC Is And Why It’s Required

JB uses a risk-based customer due diligence program to confirm identity, age, and location, and to meet AML/CFT obligations. Verification can use a third-party service and includes checks against global sanctions lists.

When KYC Is Needed

KYC can be requested by JB Casino at onboarding and later based on activity. JB may suspend an account and request enhanced checks if risk indicators appear, or when a withdrawal threshold is reached. Wallets are screened before a funding address is issued.

| Trigger | Examples |

|---|---|

| Before funding | Wallet screening and sanctions checks before issuing a deposit address or QR code. |

| Withdrawals | Extra due diligence once an account reaches a withdrawal threshold. |

| Red flags | Unusual size, volume, patterns; suspicious behavior; attempts to use high-risk addresses. |

| Location controls | IP/geo-blocking; time-zone/device checks to detect spoofing. |

Documents You May Need

Information is collected to form a reasonable belief about user identity. JB can use a third-party provider to validate materials.

| Category | What may be requested |

|---|---|

| Identity | Full legal name; date of birth; nationality; government ID with photo; ID number (passport or similar). |

| Address | Residential address (street, city, country, postal code). |

| Financial | Source of funds and source of wealth, if applicable. |

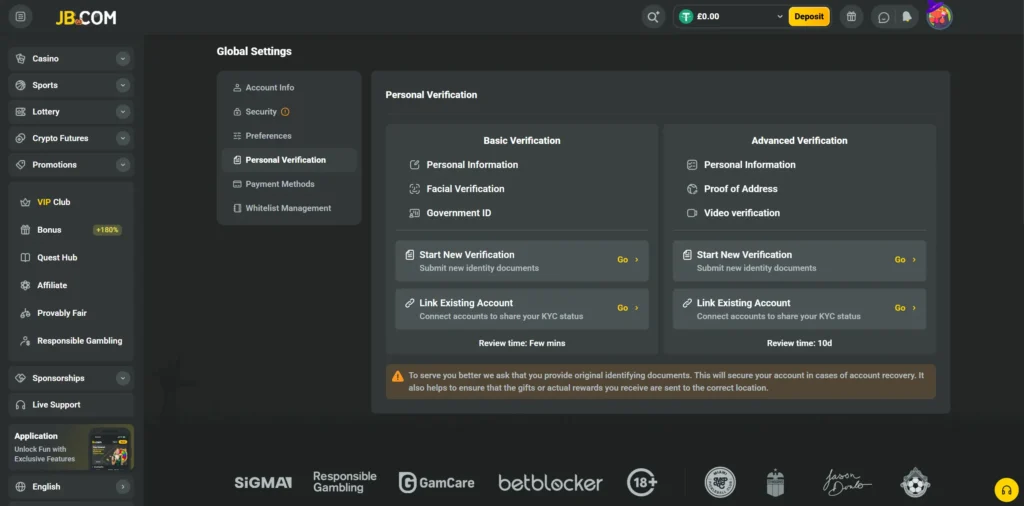

How To Complete KYC

- Open your profile and start verification.

- Enter identity details and upload clear images of requested documents.

- If asked, provide proof of address and source-of-funds documents.

- Submit and wait for review; JB may ask for extra information if something is unclear.

Processing depends on the checks required and the information provided.

Restricted And Prohibited Locations

Services are not offered in restricted jurisdictions. Access is controlled by IP-based geo-blocking; users certify they are not in prohibited or comprehensively sanctioned regions.

Ongoing Monitoring

JB screens wallet addresses, monitors transactions for unusual patterns, and may refuse withdrawals to high-risk addresses or request more information. Activity from prohibited jurisdictions can be limited.

Common KYC Issues

- Documents unreadable or expired: re-scan in good light and re-submit.

- Address mismatch: use a recent bill or bank statement that shows your name and address.

- High-risk payment route or wallet: provide source-of-funds and use a permitted method.

- Location blocked: if you are in a permitted region, contact support to review.

These checks follow the AML/KYC policy and red-flag procedures.

Privacy And Data Handling

KYC data is processed to meet compliance requirements and to prevent misuse. JB employs software, operational controls, and independent audits; a dedicated compliance function oversees the program.